On April 12, NIC released the Q1, 2018 occupancy numbers for Senior Living (including Assisted Living, Independent Living, and Memory Care).

By Steve Moran

On April 12, NIC released the Q1, 2018 occupancy numbers for senior living (including assisted living, independent living, and memory care). Calling the number “grim” would likely be too strong, nonetheless, they are concerning. They are also not a surprise or at least should not be a surprise.

The important numbers:

-

The average occupancy rate for all types of senior living (non-SNF) was 88.3%, down almost 1% from a year ago. The last time it was this low was in Q1 of 2010.

-

The independent living occupancy rate averaged 90.3%, down from 90.6% in the prior quarter.

-

The assisted living occupancy rate averaged 85.7%, down from 86.3%.

-

The assisted living occupancy rates are down 1.3% from a year ago.

Some Color

There is some thinking that flu season impacted occupancy and the absorption rates. In addition, the first quarter of the year is traditionally the slowest quarter. These numbers are based on the “major markets” that NIC tracts, but the secondary market numbers are very close to these.

One of the questions I had was what it meant in terms of absolute numbers. In other words, was there a total reduction in the number of seniors living in senior living communities? Based on conversations with NIC staff, the answer is that there are more seniors living in senior living than the quarter before . . . but just barely.

This trend does not seem to be having much impact on developer enthusiasm or capital availability.

A Sign of Things to Come

The big question is what does this mean, or does it mean anything? Some thoughts:

-

Senior living is ultimately a local business. Therefore, as long as operators and owners can pick the right markets and create the right level of differentiation, the numbers will not mean much.

-

It seems likely we will see even more frothiness in the market this year. With so many buildings owned by REITs and leased to operators, I am guessing will see some foreclosures and forced sales. But mostly we will see announcements that REITs are moving a portfolio of buildings from one management company to another, while we will be left to speculate about why it happened.

-

It continues to suggest we need to figure out better ways to tell our story and to meet the needs of those seniors who say, “No way in hell will I ever move into senior living.” This is a very unique opportunity.

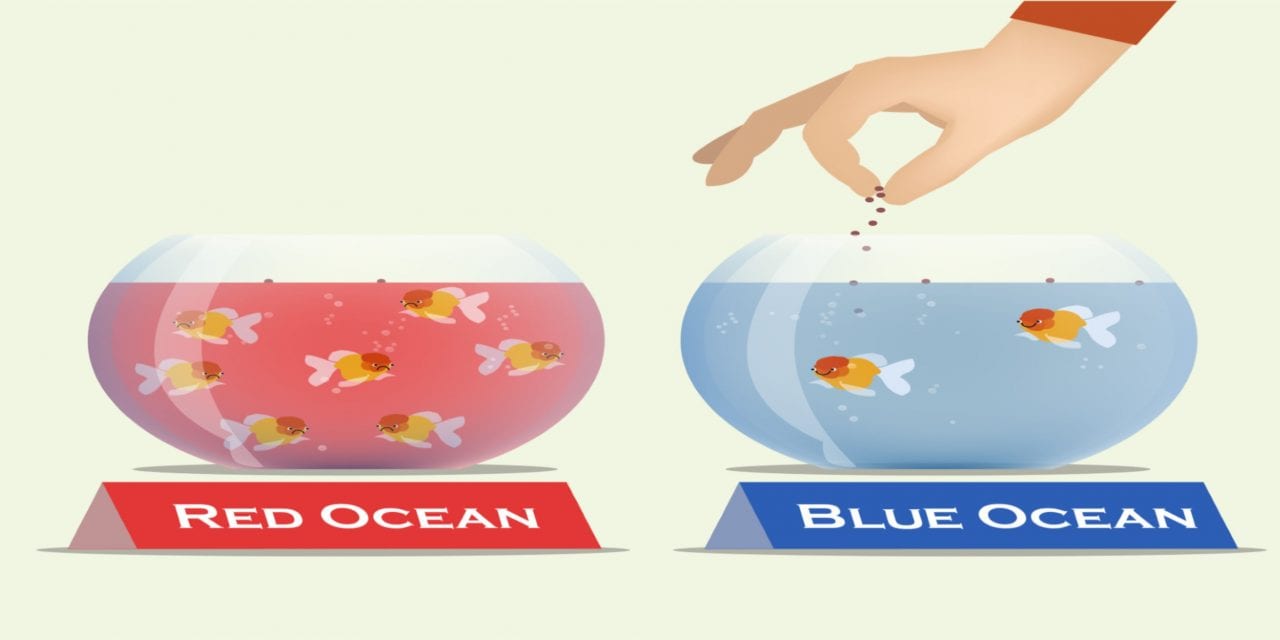

Blue Ocean – for Senior Living

This is a topic that deserves its own article and that article will be coming, but so far, we are, as an industry sector, doing a horrible job of thinking about where the blue ocean is. In other words, how can we create demand where none existed before, rather than looking to compete for the same set of residents, which is where we are today.

More elaborate common areas, bigger units (or smaller units), more dining choices, and better bingo games with bigger prizes are never going to expand the percentage of the population who say yes to senior living. In the long term, it will most likely shrink the pool because most of those things increase costs, making it even less affordable.

More than anything else, these occupancy numbers are a siren song to do some serious blue ocean thinking.